The New RAM and Extended RAM

What you need to know for new residents

The Taxation (Annual Rates for 2025−26, Compliance Simplification, and Remedial Measures) Bill includes the long-awaited proposed new taxation method for foreign investment fund (FIF) income: the Revenue Account Method (RAM). Alongside that is an expanded version, called Extended RAM. We outlined these changes back in March, and it is good to see they are now going through Parliament.

The new RAM options are intended to address valuation, liquidity, and double-taxation difficulties for new or returning migrants with overseas investments, or dual tax obligations.

Background

New Zealand’s Foreign Investment Fund (FIF) regime, introduced in the early 1990s to compensate for the absence of a general capital gains tax, was designed to prevent residents from escaping tax when they invested in offshore companies (notably US companies) that retained earnings rather than paying dividends. By taxing a deemed return on such investments regardless of whether income was received, New Zealand became an international outlier with a uniquely complex and often punitive system.

Over the decades, the FIF rules have created major problems for new residents, particularly US citizens who face double taxation because New Zealand taxes unrealised FIF income while the US taxes realised gains, without credit relief. These outcomes have repeatedly discouraged skilled migrants from relocating to New Zealand, highlighting the need for reform.

What is RAM?

The RAM (Revenue Account Method) is a method to calculate FIF income that is designed to be simpler and more familiar to many migrants: more akin to a realised gains model rather than taxing unrealised gains annually (as under some current methods). Its main features:

- Effective from 1 April 2025, eligible persons may elect RAM on an all-or-portfolio basis for eligible FIF investments.

- Under RAM:

- Taxpayers are taxed on 70% of realised gains (or losses). Gains on disposal of eligible FIF investments are discounted by 30%, then taxed at the individual’s marginal tax rate.

- Taxpayers are taxed on dividend income in the year paid.

- Losses on disposal can be claimed, but they are ring-fenced; i.e., they can be used only to offset gains under RAM, not other income. Excess losses can be carried forward.

- Cash flow: Tax is only triggered when there is actual cash flow, through dividends or sale proceeds. This approach aligns more closely with common international tax practices, where tax is typically levied on actual gains or income.

- Cost base / Valuation: When first applying RAM, the taxpayer must get a market valuation of the eligible shares at a particular date: the later of 12 months after acquisition, or when the FIF rules started applying, or the due date of their first return under which they use RAM. If obtaining a market valuation is very difficult or costly, a time-based apportionment method may be used.

- Election and exit:

The taxpayer must elect RAM in the first year in which they have FIF income and want to use RAM. There are strict timeframes for this election. If no election is made, the default remains one of the existing methods (e.g. Fair Dividend Rate). - If they later choose to stop using RAM, there is a deemed disposal of all shares under RAM at market value. Once they switch out, they cannot re-elect to RAM.

- Exit tax: If a RAM taxpayer ceases to be a New Zealand tax resident, they are deemed to dispose of all their RAM-eligible investments at market value just before departure. If the actual disposal happens within three years of becoming non-resident, New Zealand will continue to tax the disposal under RAM. It remains to be seen how this will work in practice.

Who can use RAM (Ordinary RAM taxpayers)

Not everyone will meet the eligibility criteria. To be an Ordinary RAM taxpayer:

- The person must have become a New Zealand tax resident (excluding transitional residence) on or after 1 April 2024.

- Before becoming resident, they must have been non-resident for at least five years.

- Family trusts may also apply, if their principal settlor meets the above.

Also, not all FIF investments count under Ordinary RAM. Eligibility of each investment depends on factors like when it was acquired, whether it is listed or unlisted, and whether there is a redemption facility. Only those investments acquired pre-residency will be eligible. Investments must be in non-listed entities to be eligible under the Ordinary RAM Method. There are also restrictions if there is a redemption facility available, and anti-avoidance provisions apply.

What is Extended RAM?

Extended RAM builds on Ordinary RAM but offers greater flexibility, designed for taxpayers who are taxed in another country on the basis of citizenship or right of residence/work. It is aimed at reducing double taxation and making New Zealand’s tax treatment more attractive to globally mobile persons.

Eligibility for Extended RAM

To qualify as an Extended RAM taxpayer, one must:

- Be eligible under Ordinary RAM (as above).

- Also be liable to tax in another country on the disposal of shares (or similar investments) because of their citizenship or a legal right to live or work there. Importantly:

- That other country must have a Double Tax Agreement (DTA) with New Zealand.

- The liability in the other country must be on the basis of citizenship or right to work/live there (for example, US citizens or green card holders).

- Family trusts: as with Ordinary RAM, a trust whose principal settlor meets the above may be eligible.

How Extended RAM differs from Ordinary RAM

Extended RAM provides additional benefits to eligible investors:

- Broader class of FIF investments: Extended RAM taxpayers can apply RAM to all their FIF interests, regardless of when the investment was acquired and regardless of certain constraints (like whether the share is listed, whether there is a redemption facility, etc.). Ordinary RAM is more restrictive in this regard.

- Transition and loss of eligibility: If Extended RAM eligibility is lost (for example, the person is no longer taxed overseas, or renounces the foreign citizenship/citizenship-based tax requirement), then there is a deemed disposal of investments that no longer qualify under Extended RAM. Those investments move into the Ordinary RAM regime (if they meet its criteria), or fall back to other FIF methods otherwise.

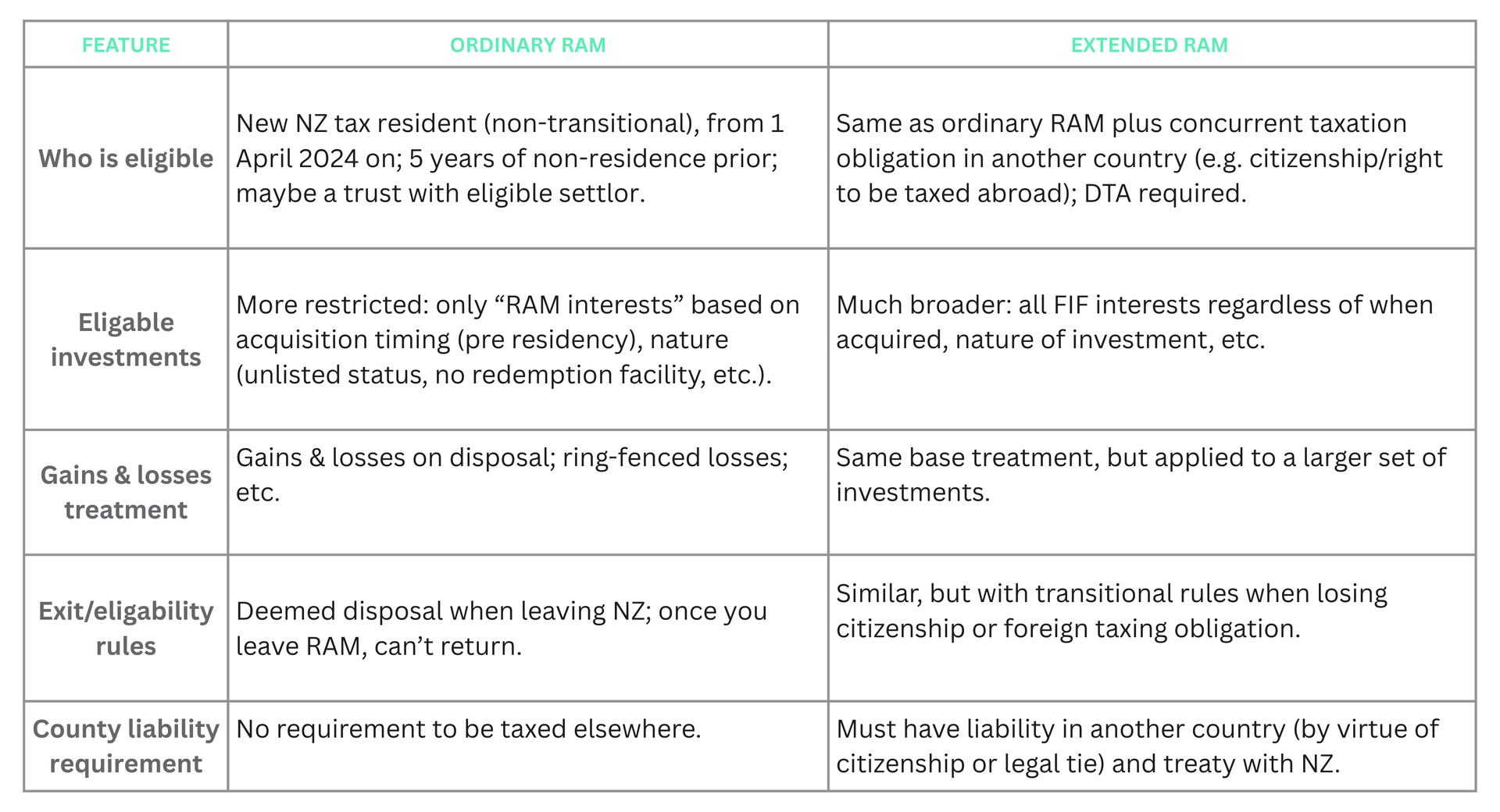

Comparison: Ordinary RAM vs Extended RAM

Here is a comparative table summarising the main differences:

Implications & Considerations

- Double-taxation risk reduced: Extended RAM is particularly valuable for people who are taxed abroad or whose countries tax on citizenship (e.g. U.S.). This method is designed to align NZ’s tax system more closely with what, and when, these taxpayers are required to return as income elsewhere.

- Attractiveness for migrants: These rules are intended to remove one disincentive for new migrants or returning New Zealanders with foreign investments, particularly investments that are hard to value or illiquid.

- Complexity remains: While RAMs reduce some issues (e.g. annual valuation, liquidity pressure), there are still costs: obtaining valuations or applying apportionment, election process, tracking eligibility, managing deemed disposals when eligibility changes.

- Expiry and switching: Once someone opts out of RAM, they cannot return. Likewise, extended RAM status can change (or be lost) triggering disposals and transitions.

Summary

These changes should better align tax with actual cash flows and investment outcomes, especially for early-stage or private equity-style investments, which are often held by professionals in the tech and start-up sectors.

However, it is important to remember that ultimately this method will still tax capital gains on these offshore investments, as well as taxing dividends. The Revenue Account Method should not be a default go-to for new residents, as some taxpayers may have more favourable outcomes with the existing FIF methods.

Contact us to discuss how these changes could affect your tax position as a new or returning New Zealand resident with overseas investments.

Disclaimer:

The information provided in this article is general in nature and does not constitute personalised tax advice. You should consult with a qualified tax adviser familiar with both New Zealand tax rules and any relevant overseas tax systems before making decisions based on this content.